Tokenomics, at its core, describes the economic principles governing a cryptocurrency or blockchain project. It encompasses the supply, distribution, and utility of tokens, shaping their value and overall ecosystem. Understanding tokenomics is crucial for investors, developers, and anyone seeking to navigate the complex world of digital assets, providing insights into potential growth, sustainability, and risk assessment.

<script async="async" data-cfasync="false" src="//pl27571810.revenuecpmgate.com/5b695ee9e17a297f791ef052f96b968a/invoke.js"></script> <div id="container-5b695ee9e17a297f791ef052f96b968a"></div>

A well-designed tokenomic model fosters a healthy and thriving ecosystem. Factors like token inflation rates, distribution mechanisms (e.g., airdrops, staking), and token utility directly impact the project’s success. Conversely, flawed tokenomics can lead to rapid devaluation, market manipulation, and ultimately, project failure. Analyzing these intricacies allows for informed decision-making and a deeper understanding of the project’s long-term viability.

Tokenomics, a portmanteau of “token” and “economics,” is the foundational economic design of a cryptocurrency or blockchain project. It dictates how a cryptocurrency functions, its distribution, its scarcity, its utility, and ultimately, its value. A well-designed tokenomic model is crucial for the long-term success and sustainability of any blockchain project. This comprehensive guide will delve into the key aspects of tokenomics, explaining its intricacies in a clear and accessible manner.

Key Components of a Robust Tokenomic Model

A successful tokenomic model considers several interconnected elements that work together to create a thriving ecosystem. These include:

1. Token Supply and Distribution

This refers to the total number of tokens created and how they are allocated. A crucial aspect is the token distribution model. This determines how tokens are initially distributed among founders, investors, the community, and ecosystem contributors. A fair and transparent distribution is essential to build trust and avoid accusations of unfair advantages. Consideration should be given to:

- Total Supply: The maximum number of tokens that will ever exist.

- Circulating Supply: The number of tokens currently in circulation.

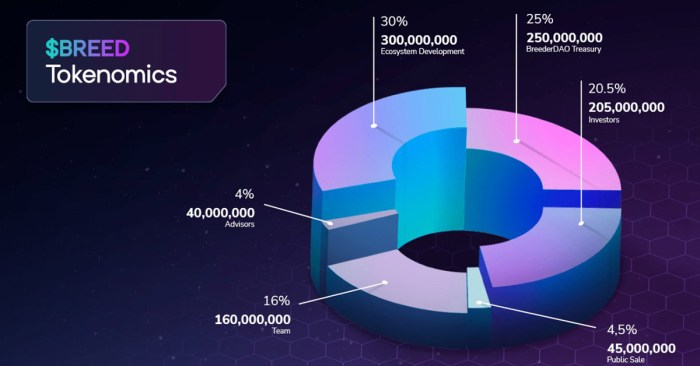

- Token Allocation: The percentage of tokens allocated to different stakeholders (e.g., team, advisors, investors, community).

- Vesting Schedules: The schedule for releasing tokens to stakeholders over time, preventing immediate dumping and ensuring long-term commitment.

2. Token Utility and Use Cases

A token’s utility defines its purpose within the ecosystem. A token with clear and valuable use cases is more likely to hold value. Examples include:

- Governance: Token holders can vote on proposals and participate in the project’s decision-making.

- Staking: Locking up tokens to secure the network and earn rewards.

- Payments: Using tokens to pay for goods and services within the ecosystem.

- Access: Granting access to exclusive content, features, or communities.

- In-app Purchases: Using tokens for purchases within a decentralized application (dApp).

3. Token Inflation and Deflation

Token inflation refers to an increase in the total supply of tokens over time, potentially diluting the value of existing tokens. Token deflation, conversely, involves a decrease in the total supply, potentially increasing the value of existing tokens. The choice between inflationary and deflationary models depends on the project’s goals and the desired economic incentives.

4. Tokenomics and Sustainability

A sustainable tokenomic model ensures the long-term health and growth of the project. This requires careful consideration of factors such as:

- Burn Mechanisms: Removing tokens from circulation to reduce supply and potentially increase value.

- Reward Mechanisms: Incentivizing users to participate in the ecosystem through rewards and bonuses.

- Economic Incentives: Designing incentives that encourage long-term participation and discourage malicious behavior.

Analyzing Tokenomics: Key Metrics and Considerations

Analyzing a project’s tokenomics requires a critical assessment of several key metrics and factors. These include:

- Market Cap: The total value of all circulating tokens.

- Circulating Supply vs. Total Supply: Understanding the relationship between the currently available tokens and the maximum possible supply.

- Token Velocity: How quickly tokens are exchanged within the ecosystem.

- Transaction Fees: The fees associated with transactions on the network.

- Staking Rewards: The rewards offered for staking tokens.

- Inflation Rate: The rate at which new tokens are added to the circulating supply.

It’s crucial to evaluate the tokenomics in the context of the project’s overall goals and the utility of its token. A seemingly attractive token distribution might be flawed if the underlying project lacks a clear use case or a sustainable business model. Thorough due diligence is essential before investing in any cryptocurrency project based on its tokenomics.

Tokenomics Examples: Different Approaches

Different blockchain projects employ diverse tokenomic models tailored to their specific goals and use cases. Some common approaches include:

- Utility Tokens: Tokens with specific use cases within a platform or ecosystem.

- Security Tokens: Tokens representing ownership or equity in an asset.

- Governance Tokens: Tokens that grant holders voting rights in the project’s governance.

- Stablecoins: Cryptocurrencies designed to maintain a stable value relative to a fiat currency or another asset.

Frequently Asked Questions (FAQ)

- Q: What is the difference between tokenomics and economics? A: Tokenomics is a subset of economics specifically focused on the economic design and dynamics of cryptocurrencies and blockchain projects. It applies economic principles to the unique characteristics of digital tokens.

- Q: Why are tokenomics important? A: Well-designed tokenomics are crucial for the long-term success of a blockchain project. They incentivize participation, ensure sustainability, and attract investors.

- Q: How can I analyze a project’s tokenomics? A: Analyze the token supply, distribution, utility, inflation/deflation model, and the overall economic incentives. Consider the project’s whitepaper and any relevant documentation.

- Q: What are some red flags in tokenomics? A: Unrealistic token distributions, unclear utility, excessive inflation, lack of transparency, and a poorly defined burn mechanism are potential red flags.

- Q: Are all tokenomics models created equal? A: No, tokenomics models vary greatly depending on the project’s goals and use cases. There’s no one-size-fits-all approach.

Conclusion

Understanding tokenomics is crucial for anyone involved in the cryptocurrency space, whether as an investor, developer, or user. A well-designed tokenomic model is the backbone of a successful blockchain project, ensuring its long-term sustainability and value. By carefully analyzing the key components and metrics discussed in this guide, you can better assess the potential and risks associated with different cryptocurrency projects.

References

Call to Action: Tokenomics

Start analyzing the tokenomics of your favorite cryptocurrency projects today! Learn to identify strong and weak models, and make informed decisions about your investments.

Detailed FAQs

What is the difference between tokenomics and economics?

While both deal with resource allocation, tokenomics specifically focuses on the economic aspects of cryptocurrencies and blockchain projects, including token supply, distribution, and utility. Traditional economics applies to a broader range of systems.

How do tokenomics affect the price of a cryptocurrency?

Tokenomics significantly influence price. Factors like inflation rate, token burning mechanisms, and overall demand all play a role. A well-designed model can help stabilize price, while a poorly designed one can lead to volatility and devaluation.

Are all tokenomics models created equal?

Absolutely not. Effective tokenomics require careful planning and consideration of various factors. A poorly designed model can cripple a project, while a well-designed one can contribute significantly to its success.